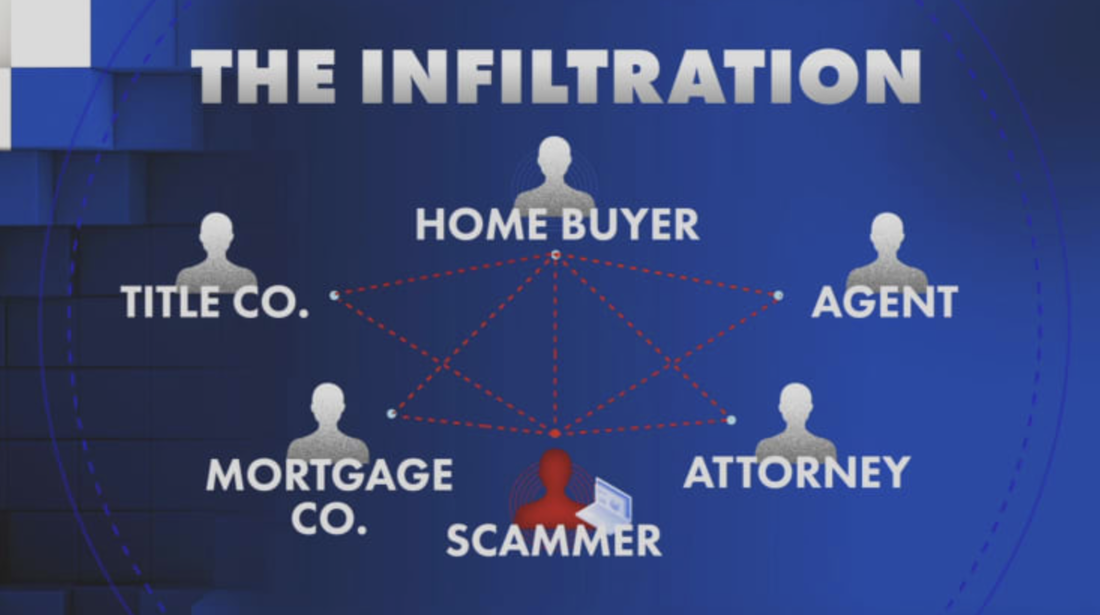

How the Scam Works

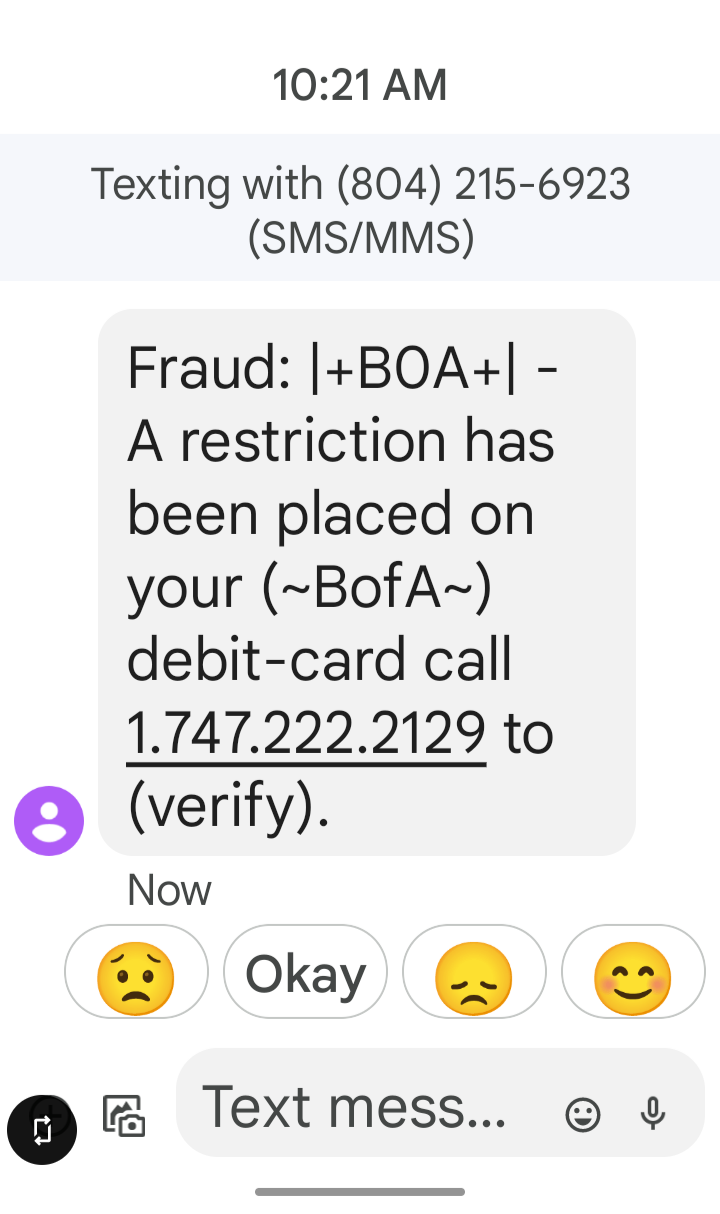

The scam typically begins with the victim receiving unsolicited messages from an unknown number or social media account. These messages often include explicit or compromising photos that the victim doesn't recognize. The scammer then claims that the photos are of a minor and threatens to report them to law enforcement or publicly expose them unless a ransom is paid. In some cases, the scammer may also threaten to send the photos to the victim's family, friends, or employer, adding further pressure to comply with their demands.

The Psychological Impact

One of the most troubling aspects of this scam is the psychological impact it can have on victims. The fear of being falsely accused of a crime or having one's reputation tarnished can be overwhelming. Victims may feel trapped, isolated, and unsure of where to turn for help. The scammers exploit these emotions to their advantage, creating a sense of urgency and desperation that can lead victims to comply with their demands without seeking proper assistance or verification.

Protecting Yourself from Photo Threat Scams

- Do Not Engage: If you receive unsolicited photos or threats, do not engage with the sender. Responding to the messages can provide scammers with more information about you and encourage further harassment.

- Verify the Source: Before taking any action, verify the legitimacy of the threat. Scammers often use fake profiles and phone numbers to create a sense of urgency and panic. Contact the platform's support team or report the message to the relevant authorities.

- Do Not Pay Ransom: Paying a ransom does not guarantee that the scammer will not release the photos or continue to harass you. In many cases, paying can lead to further demands and increased pressure.

- Report to Authorities: Contact your local law enforcement agency and report the incident. Provide as much information as possible, including screenshots of the messages and any other relevant details. Law enforcement can guide you on the next steps and help protect you from further harm. If you're unsure about what to do, call one of our experienced private investigators here at EXCALIBUR, 719-208-4088, and we can help you.

- Seek Support: Dealing with a scam can be a traumatic experience. Reach out to trusted friends, family, or professional counselors for support. Sharing your experience can help alleviate some of the emotional burden and provide practical advice on handling the situation.

Public awareness is crucial in combating this new wave of digital extortion. By educating individuals about the tactics used by scammers and encouraging them to report suspicious activity, we can collectively reduce the effectiveness of these scams. Community organizations, schools, and workplaces should consider hosting workshops or informational sessions to inform people about the risks and preventive measures associated with digital scams.

Conclusion

The photo threat scam is a stark reminder of the lengths to which cybercriminals will go to exploit and manipulate individuals. By staying informed, vigilant, and proactive, we can protect ourselves and our communities from falling victim to these malicious tactics. Remember, the key to combating digital scams lies in awareness, education, and a united front against cybercrime. If you have any questions about this scam, or any other issue you're looking for help with, contact one of our experienced private investigators at 719-208-4088 or fill out our contact form located under the Contact tab of our website.

RSS Feed

RSS Feed